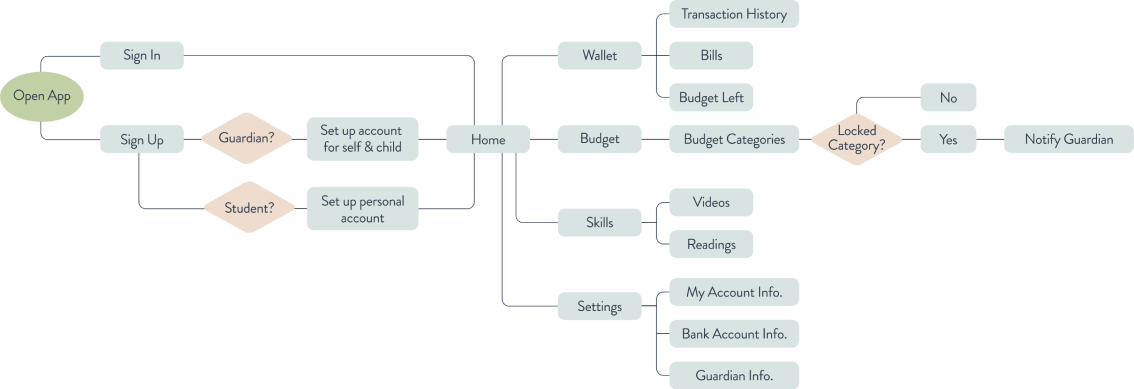

Green Nest is an app designed to assist young adults in gaining financial management skills. With this app, users can add family members and designate them as administrators, allowing them to learn and acquire knowledge regarding budgeting, savings, and expenses.

Understanding how to manage finances is a fundamental aspect of life that holds great significance. Being knowledgeable about saving, spending, and budgeting are all essential methods for regulating one's lifestyle. Although financial literacy programs are now being introduced in schools for teenagers, students are finding it difficult to comprehend the financial skills that they are expected to learn, apply, and incorporate into their daily lives.

Designing an app that allows parents to monitor and guide their children's finances while teaching young adults to manage their expenses and learn valuable lifelong lessons is a great idea. Here are some benefits:

- Parental monitoring: The app would allow parents to monitor their children's spending, receive alerts for any unusual transactions, and set spending limits for their children.

- Budgeting tools: The app would provide young adults with budgeting tools to help them track their expenses and stay within their budget. The app could also provide helpful tips and advice on how to save money.

- Savings goals: The app would enable young adults to set savings goals and track their progress. The app could also provide rewards and incentives for achieving their goals.

- Financial education: The app would provide valuable financial education resources such as articles, videos, and quizzes to help young adults learn about personal finance, budgeting, and saving.

- Reminders and notifications: The app would send reminders and notifications to users when bills are due, when spending limits are reached, or when savings goals are achieved.

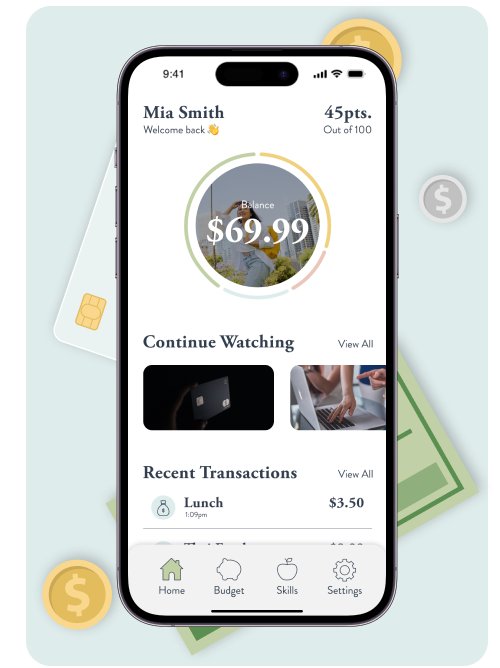

The point system incentivizes and fosters the learning process for teenagers who are learning about finance.

The balance visualization displays the current account balance, and uses borders to visually represent the distribution of the budget categories.

This content displays the latest transactions made by the user.

The icons serve as navigational aids, directing users to various sections of the application.

This feature helps the user to identify their current location within the application, making it easier to navigate and find what they are looking for.

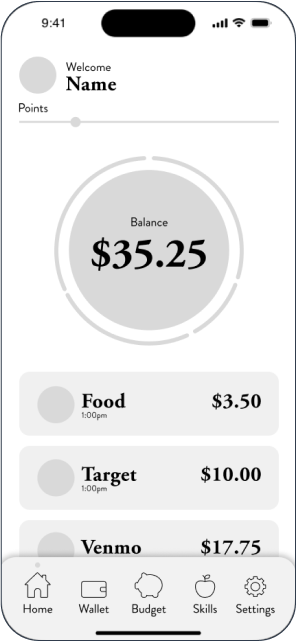

This design choice prioritizes the remaining balance of a student's budgeting system, putting emphasis on how much money they have left to spend.

Provides users with the ability to access and navigate between various sections of the screen.

Shows the users the different categories they and their guardians have created. The category would show a visual representation of how much money a user has used up from their budget.

If child spends too much money on a specific category, the guardian has the option to lock their child’s expenditures. The young adult would have to request for the spending category to be unlocked by parent.

The grid system helps in organizing the various ways of learning finance.